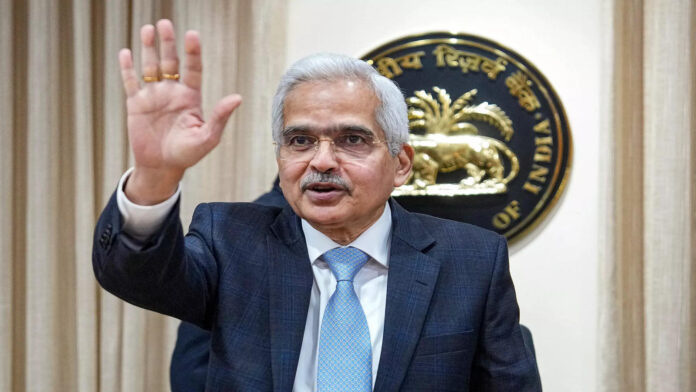

Highlights of the RBI MPC Meet: On Friday, April 5, the Reserve Bank of India (RBI) declared its decision about the repo rate, or short-term lending rate, and maintained it at 6.5%. Later today, at the post-policy presser, Governor Shaktikanta Das, the head of the six-member Monetary Policy Committee (MPC), gave a speech.

The dates of the Monetary Policy Committee (MPC) meetings were April 3, 4, and 5, 2024. Governor Das stated in his speech that “it decided by a 5 to 1 majority to keep the policy repo rate unchanged at 6.50 percent after a detailed assessment of the evolving macroeconomic and financial developments and the outlook.”

The MPC panel will convene again from June 5–7, 2024, one week prior to the FOMC meeting of the US Federal Reserve. Analysts anticipate a decision on rate continuance in June as well.

Analysts had previously predicted that India’s central bank will retain its “withdrawal of accommodation” attitude and keep the rate at 6.5%. The bank takes a cautious approach to rate increases, similar to its counterparts in Western nations. Following its final rate-hike cycle in February 2023, the Indian central bank has maintained the current rate.

Many analysts think that until the 4% inflation target is consistently met, the RBI is unlikely to lower the repo rate in the near future. The Reserve Bank of India is tasked with maintaining the country’s inflation rate between two and six percent.

Indian benchmark indexes, meanwhile, began flat ahead of today’s RBI MPC policy decision. Nifty fell 0.13 percent, while the BSE Sensex barely increased by 0.08 percent. The indices are still trading flat.