The repo rate is maintained at 6.5% by the RBI: The Monetary Policy Committee (MPC) of the Reserve Bank of India began meeting on Wednesday and has maintained the repo rate at 6.5% for the eighth consecutive quarter. The MPC convened for the first time following the announcement of the Lok Sabha election results.

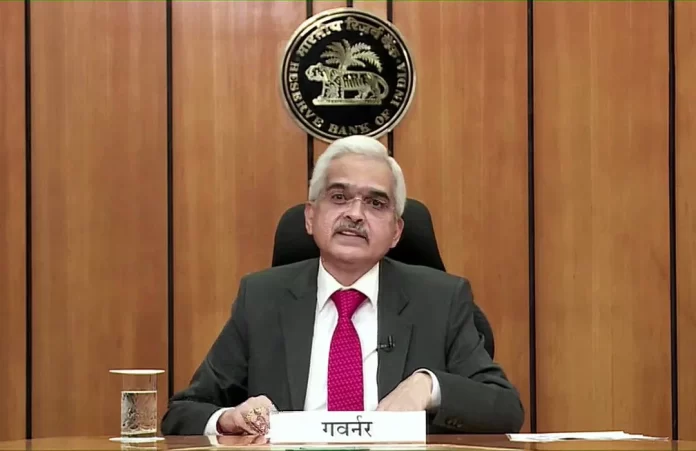

The Central Bank made the decision in April to continue its monetary policy of “withdrawal of accommodation” and to retain the repo rate at 6.5%. Under the leadership of RBI Governor Shaktikanta Das, the six-member MPC made both decisions by a majority vote of 5 to 1.

All external benchmark lending rates that are tied to the repo rate will remain unchanged as a result of the RBI maintaining the repo rate, which will relieve borrowers by preventing an increase in their equivalent monthly instalments (EMIs).

Lenders have the option to increase interest rates on loans that are based on the marginal cost of fund-based lending rates, provided that the entire 250 basis point increase in the repo rate that was supposed to occur between May 2022 and February 2023 has not yet occurred.

The RBI Governor, Shaktikanta Das, explained in April why the rates were left unchanged: “The MPC remained vigilant to the upside risks to inflation that might derail the path of disinflation, as long as food price uncertainties continue to pose challenges.” The elephant in the room was inflation two years ago at this same time, when CPI inflation had peaked at 7.8% in April 2022. Now that it’s gone for a stroll, the elephant seems to be heading back into the jungle. The Governor had continued, “We would like the elephant to return to the forest and stay there permanently.