A financial marketplace where buyers and sellers exchange shares of publicly traded corporations is the stock market. It gives businesses a platform to raise money by issuing stocks, and it gives investors a place to buy and sell these stocks. Here are some essential details regarding the stock market:

- Shares/Stocks: Businesses can raise money by issuing shares to the general public. Purchasing a share of a firm effectively makes you the owner of a little percentage of that business.

- Exchanges: Stocks are exchanged on exchanges like the NASDAQ and the New York Stock Exchange (NYSE). The foundation and infrastructure for purchasing and selling stocks are provided by exchanges.

- Investors: The stock market is attended to by both individual and institutional investors, including mutual funds, pension funds, and hedge funds. Stocks can be bought and sold by investors in the hopes of earning a profit.

- Stock Prices: Supply and demand drive the price of stocks. A stock’s price increases when more people want to purchase it than sell it, and vice versa.

- Market indices: The S&P 500 and Dow Jones Industrial Average are examples of market indices that are used to measure the overall performance of the stock market. They monitor the performance of a particular set of equities.

- Bull and Bear Markets: Rising stock prices indicate a bull market, while dropping stock prices indicate a bear market. These words are frequently employed to characterize the general mood of the market.

- Dangers: There are dangers associated with stock market investing, and the value of stocks might change due to political, economic, and company-specific variables. Investors should think about their risk tolerance and perform in-depth research.

- Dividends: A percentage of a company’s profits are distributed as dividends to shareholders by certain businesses. Dividends are a source of income for investors.

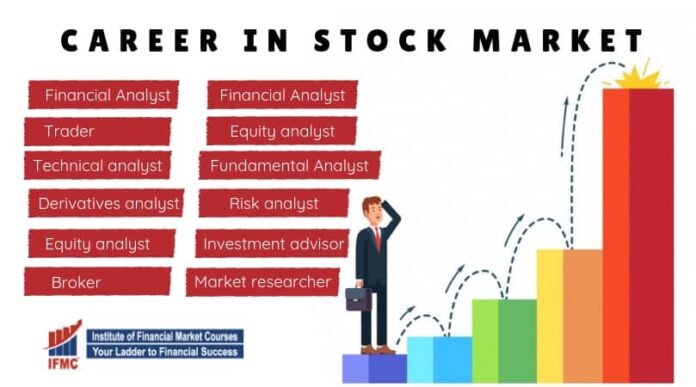

- Market Participants: These include brokers, market makers, regulatory agencies that keep an eye on the market’s operations, as well as individual and institutional investors.

- Market analysis: To help them decide which stocks to purchase or sell, investors frequently employ a variety of analytical techniques, including technical and fundamental research.

Anyone interested in investing in the stock market should educate themselves on its workings, be aware of their financial objectives and risk tolerance, and think about consulting financial experts.